A Prudent Man and the Financial Crisis

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3

Last week saw the second-largest banking collapse in American history with the implosion of Silicon Valley Bank (SVB). The failure of SVB followed closely on the heels of another bank failure, Silvergate Bank. As of this writing, there are rumors of more bank failures to come.

Do these bank failures and rumored bank failures signal an imminent collapse of the financial system? I don’t know. I’ve learned to be careful about predicting such things. The Wall Street/Washington/Central Banker establishment has thus far shown itself both dedicated to and capable of kicking the can down the road to a degree that many financial observers, myself included, did not think possible.

In my opinion, these bank failures and possible future bank failures stem from the 2008 financial crisis, which itself was never properly dealt with. The problems in the financial system that cause the Great Recession were never faced squarely and were only papered over with the “untampered mortar” of money printing, bailouts, and accounts tricks. Instead of dealing with our problems honestly, we tried to cheat our way out of the financial crisis. So it should come as no surprise that it appears to be coming back.

So what is a Christian to make of all this? How are we to respond? The Bible has a lot to say about ideas such as prudence, wisdom, and discernment. These traits were highly prized at the time of the Reformation and in the following centuries by the heirs of the Reformation.

Those with a financial or business background may be familiar with the prudent man rule. According to one definition I found, the prudent man rule is, “a rule giving discretion to a fiduciary and especially a trustee to manage another's affairs and invest another's money with such skill and care as a person of ordinary prudence and intelligence would use in managing his or her own affairs or investments.” According to this, not only are fiduciaries to manage the financial affairs of others in a prudent fashion but the notion of prudence is also tied to how they would manage their own affairs. That is, the prudent man standard encompasses the golden rule, whereby we are to treat others as we ourselves would like to be treated.

Prudence in financial and other matters served our Protestant forebears well, as it enabled them to build the greatest civilization in history. But as Christianity faded from the scene in America and other nations formerly under the influence of the Reformation, a new ethic took hold. No longer did prudence govern the thinking of men, but a sense of entitlement and instant gratification.

John Maynard Keynes, the most influential economist in the past 100 years, hated the Christian ethic of financial prudence demonstrated in the 19th century and railed against it. In his 1920 book The Economic Consequences of the Peace, Keynes wrote,

And on the other hand the capitalist classes were allowed to all the best part of the cake theirs and were theoretically free to consume it, on the tacit underlying condition that that they consumed very little of it in practice. The duty of ‘saving’ became nine-tenths of virtue and the growth of the cake the object of true religion. There grew round the non-consumption of the cake all those instincts of puritanism [n.b. the Puritans are universally despised by unbelievers such as Keynes] which in other ages has withdrawn itself from the world and has neglected the arts of production as well as those of enjoyment. And so the cake increased; but to what end was not clearly contemplated. Individuals would be exhorted not so much to abstain as to defer, and to cultivate the pleasures of security and anticipation. Saving was for old age or for your children; but this was only in theory, - the virtue of the cake was that it was never to be consumed, neither by you nor by your children after you.

Keynes, The Economic Consequences of the Peace, 19-20.

With a mindset like this, it should come as no surprise that Keynes was an apostle of deficit spending and government debt, both of which he mistakenly saw as necessary for ending the 1930s Great Depression, which itself was caused and prolonged by the interventions of central bankers and governments. Asking central bankers and politicians to fix a depression or a banking crisis is like inviting an arsonist to put out your house fire.

How widespread is the influence of Keynesian economics? A famous 1971 quote from then-President Richard Nixon is a clue. “We are all Keynesians now,” said the President. It was true then, and it remains true today. All, or nearly all, economists working in academia, on Wall Street, in corporate America, and in Washington are Keynesians of some sort or another. The baleful influence of Keynesian economic thought is substantially responsible for the sorry economic predicament of America and other western nations. What is Keynesian economics? Without delving into a lot of technical details, it’s the idea that you can deficit spend yourself rich. The “puritanical” prudence demonstrated in more Christian centuries said that hard work, savings, and investment were how you built wealth and financial security in the long run. But Keynes famously said, “In the long run we are all dead.” Various apologists for Keynes have tried to rehabilitate this statement by arguing that Keynes really wasn’t saying he had no regard for the future. But when you consider Keynes’s “in the long run we are all dead” comment in the context of his other statements such as the extended quote above, it seems entirely fair to see it as a Keynes’s dismissing the future for gratification in the now.

So back to our earlier question, how is a Christian to respond to the ongoing financial crisis? Proverbs 22:3 quoted at the top of this post provides good guidance. Notice that the prudent man does two things, he foresees trouble coming and then hides himself.

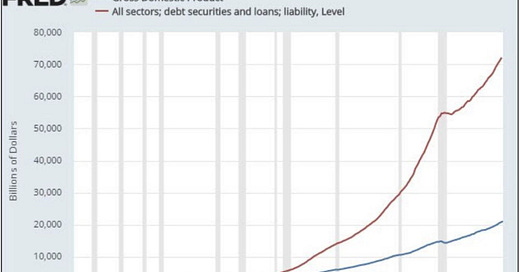

The first thing you and I need to do is to recognize that there is trouble coming. Many people, even many Christian people, do not realize the serious economic danger America and other western nations are in. The United States is over $30 trillion in debt. And that’s just federal debt. It doesn’t include state, municipal, corporate, or individual debt. And the debt keeps growing. In fact, given that our financial system is based on debt, the debt must keep growing to sustain the system. Obviously, debt cannot expand infinitely and forever. God has so constructed the universe that all debts must be paid. Just look at the chart at the top of this post. Do you think debt can continue to grow faster than income? If not, the current financial system must come to an end. It’s a matter of when, not if, we have a system-down event. The timing of the collapse is uncertain. But in my opinion, it’s probably sooner rather than later.

Second, as Christians, we must hide ourselves. What does this mean in the context of a financial crisis? A lot of those old-fashioned “puritanical” ideas, the sorts of things that Keynes and others of his ilk hated and made war on a century ago, are a good place to start. Eliminating debt and building savings is wise counsel. And when I say savings, I mean at least some of that savings should be held outside the financial system. That means having some ready physical cash at home. It also means holding some savings in dollar alternatives. The best dollar alternatives are physical gold and silver, but there are other options as well.